In May of this year, Rose graduated from college with a Bachelor’s in Business Administration. She was flying high: she had her degree, she had started her own business, a nail salon, which was close to running a profit, she liked living in San Jose with her boyfriend. Life was good, and she was taking a vacation with her parents to celebrate her achievements.

The first thing that augured a problem was pretty innocuous: a credit card purchase was declined. These things happen, and Rose didn’t pay too much attention. She was on vacation after all. Next, she got an email that her credit limit was increased to $1900, from $1500, without further explanation. A week or so later, she found out that the Wells Fargo bank account she used for internet purchases was wildly in the red. How could this have happened?

Someone had gotten into Rose’s bank account, which had $25 in it at the time, and siphoned about $1400 to Western Union, where it becomes essentially untraceable. The bank account is linked to her credit card–the one for which the credit limit was raised. The fraudulent transaction went through, but since the credit limit on her card was insufficient to cover the amount, she ended up maxed out on her credit card and in the red on her bank account.

Rose appealed to Wells Fargo for help, but all they did was slap her with one overdraft fee after another. Everyone she talked to said it was not their fault. They said they would investigate, but only after she had reported the theft to the police and to the FBI. Even so, they didn’t offer her much hope of recovery. She went to the police, to see if they would help her, but they said there was nothing they could do. And the overdraft fees kept coming. She went to the FBI, because the money had crossed state lines, given the involvement of Western Union, they said there was nothing they could do. And the overdraft fees kept coming.

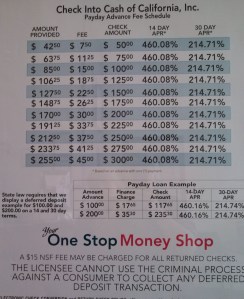

Now Rose had to borrow money to stop the overdraft bleeding. She requested a personal loan, to get back into the black, but the overdraft fees had ruined her credit score and the bank declined to give her the loan. And the overdraft fees kept coming. She tried other banks, but they declined to help her for the same reason. And the overdraft fees kept coming, the overdraft fees kept coming. So Rose tried to get a payday loan, but all they can give you is $400 and by now she needed thousands. She tried crowdfunding to come up with the money, but she didn’t make her goal and came up with zero. And the overdraft fees kept coming.

In more and more desperate straits, Rose turned to her family and asked for help. She had hesitated, because in her community it is embarrassing to owe money, even if it’s not your fault. At first, her family didn’t understand her situation. When they finally did understand, they told her they didn’t have anything to spare. And, remember, all this time, the overdraft fees kept coming. In all, it took about a month for the bank to put her $3000 in the red.

Eventually Rose gave up and turned to an online usury outfit, loanme.com, which offered her a $3100 loan, took $100 off the top in fees, and then started charging her an interest rate of 135%.

By now Rose has two jobs. She’s a carrier for Amazon, with irregular hours. She has another part-time job, also with irregular hours. She’s running her nail salon–which generates just enough revenue to allow her to pay her employee. And she’s looking for a better-paying job to be able to pay back that loanme.com loan. She hopes to pay off that loan before the end of the year, because in January her student loans kick in. So far, she has paid $800 to loanme.com, of which $2.00 went to reduce the principal, meaning she still owes $3098. What if she can’t pay it off before January? “Then I’m screwed,” Rose explains.

So here’s the score:

- Thief takes about $1400 (illegally, but with impunity).

- Bank takes something on the order of $3000 (totally legally).

- Loanme.com takes at least another $3000 or so (legally) if Rose pays off the loan by December. Much more if she can’t (also legally).

They are pretty much indistiguishable, except the legal ones seem to have more leverage.

So what to do? There are a few things:

- We can help Rose out. (Email fairnetwork at gmail dot com if you want to know how.)

- We can stop giving ourselves hostage to a major bank and go to a credit union instead.

- We can support postal banking proposals (read How the Other Half Banks, by Mehrsa Baradaran and join the FAIR Money reading group to talk about it on October 12).

- We can push the CFPB to do something about bank fees. Maybe.

Any other ideas? Please let us know. We’d love to hear them.